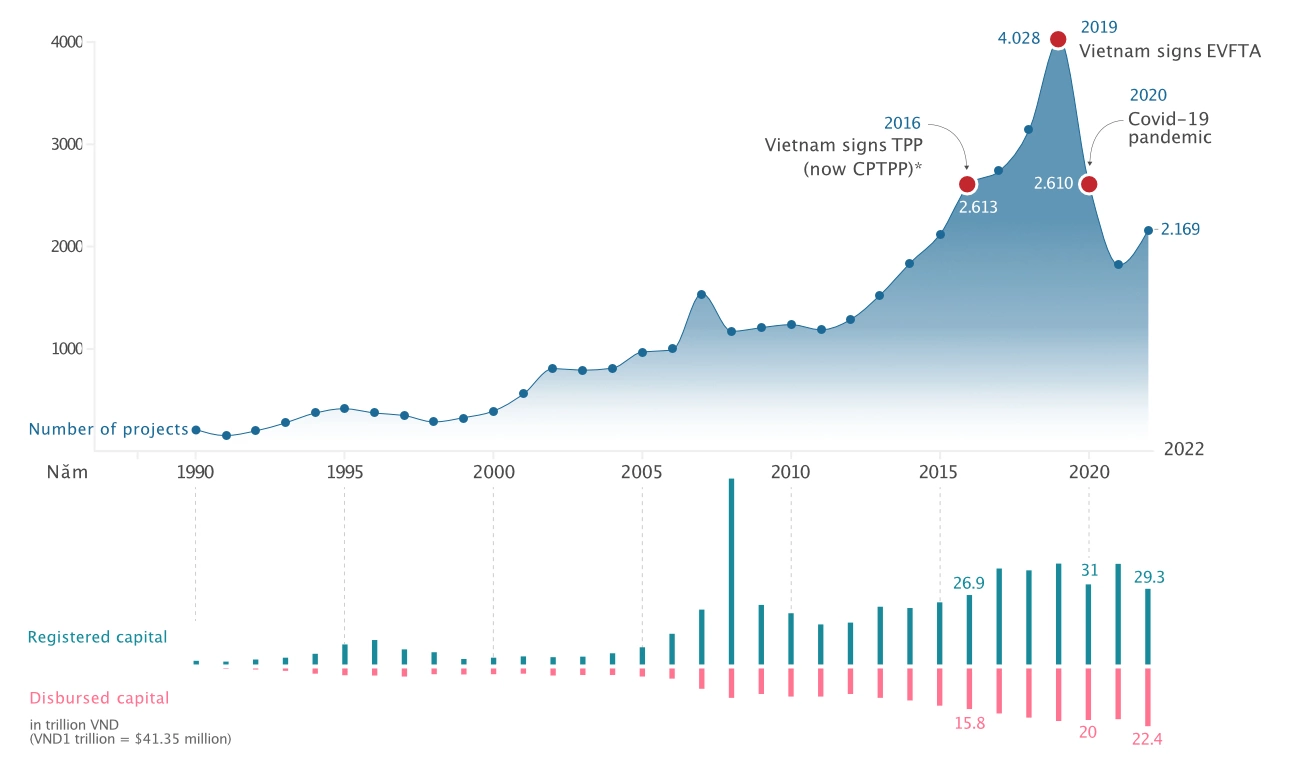

Over 35 years, Vietnam’s registered foreign direct investment (FDI) has grown to US$524 billion from just US$2 million in 1988.

By the end of 2022, upwards of 36,000 FDI projects were active with total funds of $441 billion, 57% of which have been disbursed.

In 1988, Vietnam's economy started a new chapter with its first-ever FDI project in the southern province of Ba Ria – Vung Tau. For the first few years after that, foreign investors were still hesitant, thus projects and capital only trickled into Vietnam.

By 1991, FDI growth sped up, marking the first big wave of foreign investment, with projects and capital value constantly surpassing previous records.

Many industry giants flocked to Vietnam to outsource their manufacturing, like Taiwanese footwear producers PouChen and Feng Tay, and Japan's Honda with its motorbikes.

The FDI market grew cold with the 1998 Asian financial crisis and did not recover until 2002.

In 2006, Vietnam welcomed its first few billion-dollar projects from American chipmaker Intel and South Korean steel manufacturer Posco, gathering a new record of US$10 billion and marking the second big FDI wave for the country.

Total registered FDI then climbed to a new height of US$72 billion in 2008, the same year in which South Korean conglomerate Samsung – now Vietnam’s largest foreign investor, began constructing their first factory in Bac Ninh Province.

The 2008 global financial crisis wreaked havoc on Vietnam’s FDI resulting in actual FDI disbursed fluctuating around US$10-11 billion, much lower than initially committed.

From 2015 to 2019, FDI made a comeback, marking the third big wave of foreign capital, during which FDI did not spike abruptly like in the 2005-2008 period, but grew consistently. The pandemic at the start of 2020 put a halt on cross-border investments, causing FDI to plunge.

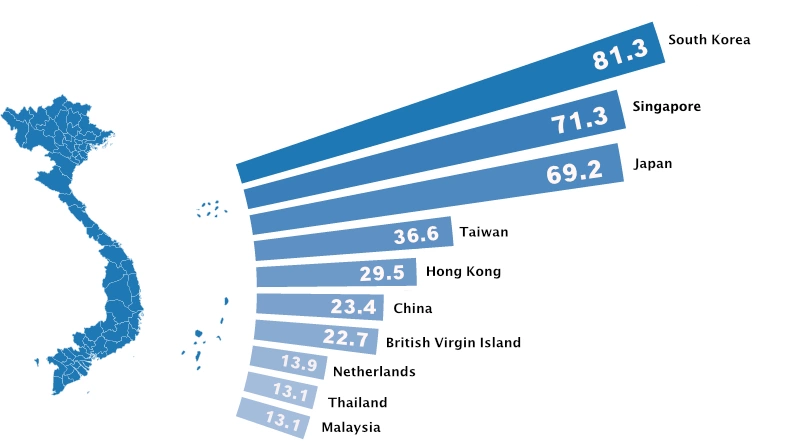

After 35 years, South Korea, Singapore and Japan are the three biggest contributors to Vietnam’s FDI. The U.S. does not even make it into the top 10.

With Vietnam-U.S. relations upgraded to Comprehensive Strategic Partnership in early September this year, Vietnam is expected to receive its fourth big wave of FDI with a capital injection from the world’s biggest economy.

Since the start of the 2000s, FDI has slowly become one of the pillars of Vietnam’s economy.

At present, FDI contributes 19% to the country’s GDP while providing jobs to 35% of its labor force despite only accounting for 3% of businesses.

Among the three engines of Vietnam’s economic growth, namely investment, domestic consumption, and export, FDI contributes mostly to the latter.

Back in 1995, foreign companies only made up 27% of Vietnam’s exports, while their domestic counterparts produced 73%.

However, 30 years later, their positions are reversed.

Currently, for six out of the eight main export commodities with sales topping US$10 billion, the FDI sector owns more than 50% of the market share.

Notably, FDI businesses account for around 98% of exports of high-technology products like computers, electronics, mobile phones and spare parts.

The FDI sector is also more efficient than the domestic sector.

For 12 out of the 17 years from 2005 to 2021, FDI surpassed private and public sectors, the two components of the domestic sector, in growth and earning power, despite some large FDI businesses reporting net losses.

Since 2010, the profit margin of the FDI sector has inched ahead of the public sector, and is two to three times higher than private sector.

In terms of workforce, 56% of businesses with more than 1,000 staff are FDI companies, meaning over half of the big companies in Vietnam all some foreign capital.

Attracting FDI does not just contribute to Vietnam’s growing GDP, it also signifies the country’s increased international collaboration and heightened global status, according to Phan Huu Thang, former director general of the Ministry of Planning and Investment’s Foreign Investment Agency (FIA).

Thang says FDI has brought plenty of technology and management experiences to help Vietnamese businesses, many of which have since developed their own large projects across various fields, such as real estate, petroleum, transport, and IT.

Nonetheless, some major limitations remain, notably the inefficiency in transferring technology and the lack of collaboration between the FDI sector and domestic counterparts.

Only 13% of FDI companies are joint ventures between foreign investors and local businesses, the rest are 100% foreign-owned.

All technology transfer contracts, around 400 in number, made by FDI companies in the past five years have not involved local companies.

According to Thang, Vietnam’s supporting industries, a term that encompasses all industries that supply production inputs or intermediate goods, are not developed enough, and the government has not paid enough attention to training a quality labor force and pushing Vietnamese businesses to collaborate with FDI companies.

"If foreign investors are willing to share their technology, who should they transfer it to?" he says.

Thang says that when Honda opened its first factory in Vietnam back in the 1990s, the Japanese company surveyed tens of local mechanical contractors, mostly government-owned companies. However, it could not find a single partner to produce car parts and accessories.

Industrial research expert Nguyen Thi Xuan Thuy believes Vietnam has not fully utilized its opportunities to learn from foreign investors.

Collaboration between FDI and domestic sectors is still unregulated and the number of local companies involved in international supply chains is limited.

Additionally, unregulated FDI projects have left "painful scars," like the Vedan wastewater disposal scandal in Dong Nai back in 2010, the Formosa waste disposal scandal in 2016, or when many FDI factory owners declared bankruptcy and fled Vietnam without paying salaries owed to their workers in 2018.

Even so, Thang stresses that considering Vietnam started out at zero without the infrastructure and superstructure to manage market economy, technology and finance, the 35-year journey on FDI has been a success.

To avoid similar scandals, he suggests the government should adopt a different view, one that focuses more on "cooperating" with foreign companies rather than just "attracting" them, to better utilize FDI.

"While able to attract the shifting global capital flow, Vietnam still has a long way to go if it truly wants another big wave of investment," he adds.

Data sources:

– Data on 2022 foreign investment and export cited from the General Statistics Office of Vietnam and the General Department of Vietnam Customs.

– Information on the three big FDI waves cited from "Làn sóng đầu tư trực tiếp nước ngoài thứ ba" ("The third wave of foreign direct investment") study by Prof. Nguyen Mai, president of Vietnam’s Association of Foreign Invested Enterprises.

Story by Viet Duc, Le Tuyet

Graphics by Hoang Khanh, Thanh Ha